Taking control of your finances can be a challenging task, especially if you are struggling with overspending or debt. For me, budgeting was a game-changer that helped me take control of my finances and achieve my financial goals.

When I first started budgeting, I tried using various popular and expensive budgeting apps and even hired a bookkeeper to help me manage my finances. However, neither of these methods worked for me. The budgeting apps were confusing and time-consuming, and never had everything that I wanted to implement it was always missing a key feature. The bookkeeper cost me thousands of dollars but didn't provide me with the clarity I needed to understand where my money was going.

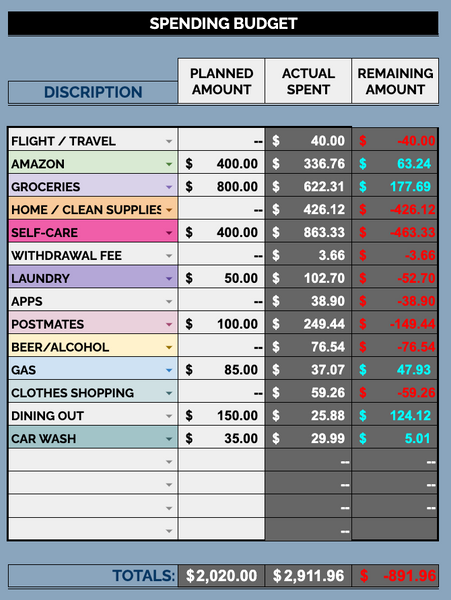

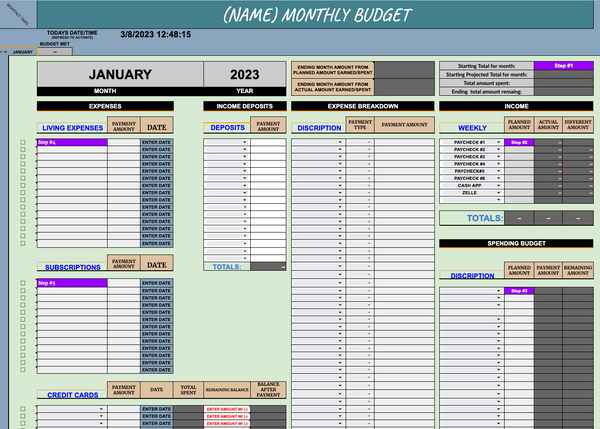

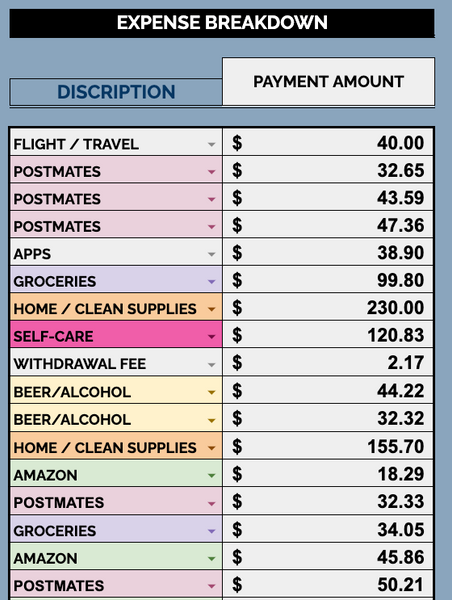

That's when my boyfriend stepped in and spent over 3 months finessing a budget template that I am beyond proud of. He created a mastermind budget that was easy to use, auto-populated, and a complete game-changer for our financial success. I use a far more intricate one for my business and a more simpler version for my personal budget. This tool has helped me understand where my money was going, where I could cut back on expenses and where I c can save. Image to my shock, seeing in front of me that I was spending $800 a month on Amazon, on products that I didn't truly need!

Using the mastermind budget, I was able to track my spending, set financial goals, and prioritize my spending. I was able to pay off my credit card debt and save money for a down payment on a house. Plus, my boyfriend and I were able to communicate better about our financial priorities and work together toward our shared goals.

I'm grateful for the mastermind budget my boyfriend created and tailored just for us and I want to share it with others who may be struggling with their finances. If you're interested in purchasing the mastermind budget for yourself or your family, you can email [email protected] for more information.

In conclusion, budgeting can be a powerful tool for achieving financial success and reducing financial stress. If you're struggling with overspending or debt, I encourage you to give budgeting a try. And if you're looking for a budgeting solution that really works, consider the mastermind budget created by my boyfriend - it could be a game-changer for your financial success too!

Taking control of your finances is essential for achieving financial stability and reaching your long-term goals. One of the most effective ways to do this is by implementing a budget. A budget is simply a plan for how you will spend your money, and it can help you manage your finances in a more deliberate and intentional way. Here are some reasons why you should consider creating a budget for yourself, your family, or your significant other:

- Budgeting helps you track your spending.

One of the most significant benefits of budgeting is that it allows you to see where your money is going. By tracking your expenses, you can identify areas where you might be overspending and make adjustments accordingly. This can help you reduce your spending and save more money over time.

- Budgeting helps you set financial goals.

When you create a budget, you can set financial goals and allocate your resources accordingly. For example, you might want to save for a down payment on a house, pay off debt, or build an emergency fund. By prioritizing your goals and allocating your resources, you can make progress toward achieving them.

- Budgeting helps you avoid debt.

By tracking your spending and setting financial goals, you can avoid overspending and accumulating debt. When you have a budget, you know exactly how much money you have available for discretionary expenses, and you can make informed decisions about how to spend it.

- Budgeting helps you communicate with your family or significant other.

If you are in a relationship, creating a budget together can help you communicate about your financial priorities and goals. By working together, you can ensure that you are both on the same page and that you are working toward shared goals.

- Budgeting helps you reduce financial stress.

When you have a budget, you have a clear plan for how you will spend your money, which can help you feel more in control of your finances. This can reduce financial stress and anxiety, which can have a positive impact on your overall well-being.

In conclusion, budgeting is an essential tool for taking control of your finances and achieving your long-term goals. Whether you are budgeting for yourself, your family, or your significant other, it can help you track your spending, set financial goals, avoid debt, communicate with your loved ones, and reduce financial stress. So why not give it a try and see how it can benefit you?